Best Mortgage Rates in 2026: Where to Find 5.75% APR (Exposed)

After two years of elevated rates, mortgage rates have finally dipped below 6% for well-qualified borrowers in early …

After two years of elevated rates, mortgage rates have finally dipped below 6% for well-qualified borrowers in early …

The credit card market in 2026 offers some of the most generous sign-up bonuses and rewards rates we’ve ever seen. …

If your savings account earns less than 4% APY in 2026, you’re leaving money on the table. While traditional banks …

Investing has never been more accessible. In 2026, you can start building wealth with as little as $1, pay zero …

The average American retires at 64 with $255,000 in savings. Financial experts say you need $1-2 million. The reality is …

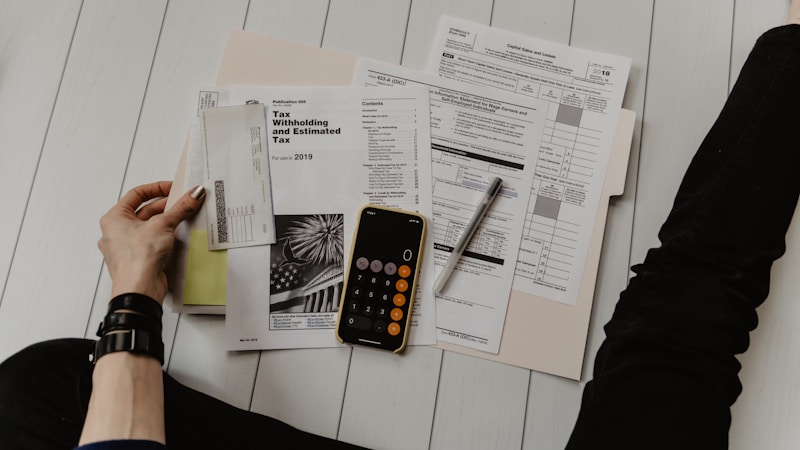

Tax season 2026 is here, and you have more options than ever for filing your return. From completely free options to …

Managing money shouldn’t be complicated. The best budgeting apps in 2026 automatically categorize your spending, …

Whether you need to consolidate high-interest debt, finance a home renovation, or cover an unexpected expense, a …

The average American carries $6,500 in credit card debt at 21-27% APR interest rates. At minimum payments, paying off a …

Your credit score affects almost every financial decision you make — from the interest rate on your mortgage to whether …

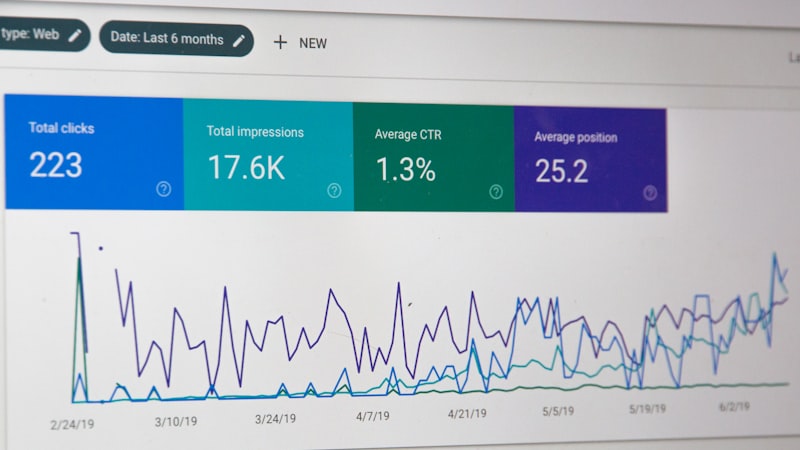

Robo-advisors have grown from a niche fintech experiment to managing over $1.5 trillion in assets. These automated …

With mortgage rates dipping below 6% in early 2026, millions of homeowners who locked in rates above 7% during 2023-2024 …